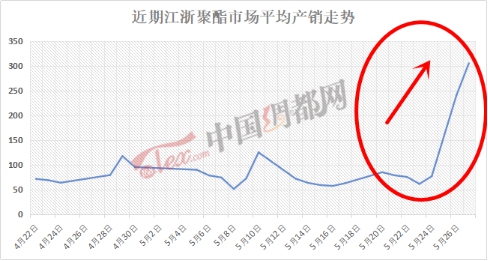

Last weekend, the overall production and sales of polyester filament in Jiangsu and Zhejiang areas rebounded significantly. The two-day average production and sales were estimated to be around 240%, and some better production and sales reached 400%, 600% or even 1000%!

On the 27th, the overall production and sales of polyester filament in Jiangsu and Zhejiang continued to improve. The average production and sales on that day were estimated to be slightly above 300%, and some of them were better. Production and sales reached around 400%, 500% or even 700%!

In addition, it is reported that a leading company announced on the 27th that sales of civilian silk exceeded 200 million!

Sales exceeded 200 million, production and sales exceeded 1000%… That’s right, Such a domineering polyester filament sales! With one stone, the production and sales of polyester filament exploded. All products in the polyester industry chain were not to be outdone, triggering a wave of carnival PARTY in the industry chain of “rising, rising, rising”!

1. A sharp increase of 2.1%, and international oil prices are rising rapidly!

The crude oil market suffered a heavy setback in the previous period, with last week recording the largest weekly decline this year. Last week, the main contract of NYMEX crude oil futures fell below US$60/barrel to US$59/barrel; the main contract of Brent crude oil futures once fell to around US$67/barrel; the main contract of China’s crude oil futures 1907 also once hit a new low of 463.6 yuan since early April. / barrel, as of the close of last Friday, the three had fallen by 6.16%, 4.03%, and 7.3% respectively for the week.

Just when the market was pessimistic about crude oil, we were caught off guard. On the 27th, international oil prices skyrocketed! On that day, New York crude oil July futures exceeded 1%, reaching a daily high of 59.26 US dollars/barrel; Brent July crude oil futures closed up 1.42 US dollars, or 2.067%, at 70.11 US dollars/barrel, rising above 69 and 70 US dollars during the session. Dow’s integer mark; Brent crude oil August futures rose as much as 2.1% during the session, reaching a new daily high of $68.86 per barrel.

2. Up 2.26%, PTA futures opened higher and moved higher!

The high production and sales of the polyester filament market for three consecutive days is an intuitive reflection of the positive effects on the PTA futures market. Stimulated by the positive overall production and sales of polyester, PTA futures, which had been sluggish for many days, surged more than 2% at the opening on the 27th and fluctuated at high levels during the day. The main 1909 contract closed at 5,436 yuan/ton that day, which was the same as the previous trading day. Compared with the price, it increased significantly by 120 yuan/ton, an increase of 2.26%. The front-month 1907 contract closed at 5542, up 2.74%. On the 28th, PTA futures continued to open higher and move higher. The main 1909 contract closed at 5,448 yuan/ton, which was an increase of 56 yuan/ton, or 1.04%, compared with the settlement price on the previous trading day.

As for the spot price, since major PTA manufacturers suspended spot repurchases, the spot price of PTA has dropped by nearly a thousand yuan compared with the first half of the month; recently, the futures market has been boosted and equipment maintenance has been good. Driven by the good news, there are also signs of rebound. It is reported that Chongqing Pengwei’s 900,000 tons/year PTA unit will start maintenance on May 26, and the maintenance is scheduled to take 10-15 days; while Fuhai Chuang’s 4.5 million tons/year PTA unit is scheduled to be overhauled in July.

3. Drop, drop, drop, polyester filament stocks have finally dropped!

With the sluggish production and sales of polyester filament not long ago, the biggest headache for polyester manufacturers is inventory pressure; the high inventory during mid-May was almost equivalent to High inventory levels during Chinese New Year. In this “Red May” when there should be no inventory pressure, such high inventory really doubles the pressure on polyester manufacturers. Fortunately, driven by high production and sales for many days, the high inventory pressure of polyester manufacturers was finally relieved and declined rapidly. According to statistics from the China Silk City Network, the overall inventory of the polyester market has dropped to 14-22 days. In terms of specific products, POY inventory is concentrated in 6-11 days, FDY inventory has dropped to around 13-18 days, and DTY inventory has dropped to around 13-18 days. The inventory lasts for about 21-27 days.

This wave of “explosion” in the production and sales of polyester filament is ultimately due to the demand cooperation of weaving manufacturers.

On the one hand, it is the rigid purchase of weaving manufacturers. Nowadays, the raw material inventory of weaving manufacturers is at a relatively low level. big influencing factors. In the past month or so, as the price of raw materials has been slowly declining, downstream weaving manufacturers are generally more cautious in purchasing raw materials and are not very enthusiastic about stocking up. Most of them purchase on demand, mostly in accordance with their own production, and have no plans to stock up. . However, nowadays, the overall operating rate of the weaving market is mostly around 70-80%. Weaving manufacturers mostly meet rigid needs or consume early raw materials, so there will inevitably be a certain purchase demand near the end of the month.

On the other hand, because the price of polyester yarn is at a low level during the year, weaving manufacturers are enthusiastic about low-level purchasing. It can be seen from the sample companies tracked by China Silk Capital Network that the raw material inventory of weaving manufacturers is currently at a relatively low level, falling to an average of about 7-10 days, a month-on-month decrease of nearly 10 days; according to common practice, generally weaving manufacturers will stock up for 10-15 days of raw material inventory is used for turnover. This time there is a sudden increase in raw material prices. Driven by the mentality of buying up rather than buying down, downstream weaving manufacturers will more or less replenish some raw materials, stimulating purchasing enthusiasm.

Although after this large-scale transaction, the inventory pressure of polyester manufacturers has been greatly relieved, and they can easily ” “Unloading”; but for the polyester industry chain, problems that need to be faced still exist!

First of all, the end demand performance is naturally poor. The sales of weaving manufacturers are not very satisfactory. The decline in transactions has led to an increase in inventory. According to statistics, the current inventory of gray fabrics in Shengze has risen to about 40 days. For polyester The subsequent production and sales demand for filament yarn may be difficult to sustain.

Secondly, whether it is the operating rate of the weaving market or the installation load of polyester manufacturers, they are facing declines to varying degrees, and the rigid demand for polyester or PTA has correspondingly decreased.

For polyester manufacturers, problems such as hovering near the profit and loss line, difficulty in continuing production and sales, and poor demand transmission still need to be faced! </p